Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a product manager who has a joint income of $330,000 and spends some of her money this week on beer.

Occupation: Product Manager

Industry: Software

Age: 26

Location: Digital Nomad (US-based)

My Salary: $150,000

My Partner’s Salary: $180,000

Net Worth: ~$383,000 combined (401(k): $144,000, Roth IRA: $56,000, I-bonds: $31,000, cash: $68,000 (mostly in HYSA), stocks: $55,000, HSA: $7,000, car values: $22,000. I share finances and split all bills with my partner. We combine and split our income ~50/50 between the two of us. My partner has about $35,000 more than me to his name but we think of our net worth as combined and all of the above are our combined amounts).

Debt: $0 (we’ve paid off both cars and all student loans).

My Paycheck Amount (biweekly): $2,350

My Partner’s Paycheck Amount (2x/month): $3,500

Pronouns: She/her

Monthly Expenses

Rent: We are doing month-to-month rentals in different cities, which have averaged about $2,700 per month. This is cheaper than our rent in our original city so we are saving some money by traveling, especially because that includes utilities. All monthly expenses come from our joint accounts/directly from our paychecks.

401(k): $3,750 (combined).

Netflix: $16 (I pay for this family plan, my mom pays for Spotify and my partner’s family pays for Hulu and HBO).

Gym: $45

ESPP: $1,083 (just me, from my paycheck).

Health/Dental/Vision Insurance: $119

HSA: $579

Cell Phones: $100

Annual Expenses

Car Insurance: $1,050 (twice a year).

Roth IRA: $13,000

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes but mostly because I excelled in and enjoyed school. My parents would have been disappointed if I didn’t go to college but would have let me make my own choice. I received a bachelor’s and master’s degree. My parents paid the bulk of my undergrad and the rest was covered through scholarships (~$20,000), loans (~$20,000) and my employer paying for some of my master’s (~$25,000). I also went to an in-state university, which saved a lot on tuition costs.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My family didn’t talk too much about money, though I did get a savings account as a kid and was told about the importance of saving. My parents also loosely told us about how they were saving for retirement and making sure to never go into credit card debt etc. When I graduated college, my parents emphasized that I should be sure to contribute to my 401(k) and live within my means but I wouldn’t say we had any formal conversations or education about money. I’ve learned a lot of what I know on my own since graduating and managing my own money.

What was your first job and why did you get it?

My first job was at an ice cream shop at 16. I mostly got it to have money for gas, shopping and hanging out with my friends. I only worked in the summers until I was a senior in high school, when I started babysitting during the week as well.

Did you worry about money growing up?

Definitely not — money wasn’t really an issue for my family and I don’t think I ever had a time I was worried about money. There were definitely times I wanted something and my parents said no, probably because of cost, but I never felt worried about things I needed like food, shelter or basic clothes. We also traveled a lot, which was not common among my peer group, so I actually often had the sense I was really fortunate.

Do you worry about money now?

I wouldn’t say that I worry but money is definitely on my mind a lot — especially with saving for a down payment and a wedding. We definitely feel good about the savings and incomes that we have but homes near our families are extremely expensive and it feels like we need to save for several more years to be able to buy in the area we want. Other than buying a house, money is definitely not something I worry about too often. We are able to afford mostly everything that we want within reason.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I think I truly became financially independent at 22 when I graduated undergrad. That’s when I started paying for everything on my own, with the exception of health insurance, which I was on until earlier this year. I would consider myself and my partner our own safety net. I can’t think of a scenario where we would need to turn to our families for money but if we did, I’m sure they would provide what we needed to get back on our feet.

Do you or have you ever received passive or inherited income? If yes, please explain.

The biggest one I can think of is my parents paying for most of my undergrad tuition and living expenses. My parents also paid for the first car I drove, which I shared with my siblings. I have never had any inheritance or trust; luckily all of my grandparents are still with us. I expect when they pass I will receive some money but that’s something I hope doesn’t happen for a long time. My partner also had his undergrad paid for completely, no other allowance or trusts/inheritance.

Day One

9:30 a.m. — Wake up for the last day in our Airbnb in New Orleans. Today we will be leaving for our next stop: Austin, TX! Even though we both took PTO, my boyfriend, H., has to take one work call quickly. I pack the car up while he wraps up work. Once he is done, we’re off. I take the first shift driving.

1 p.m. — We didn’t eat breakfast and I am getting hungry so we stop for Subway footlongs ($18). We decide to eat in Subway to take a little break from driving, then stretch our legs in the parking lot before taking off again. For the next stretch of the drive, we listen to The Skinny Confidential, my favorite podcast. $18

2:30 p.m. — I pull over in Lake Charles, Louisiana and we walk around to stretch. I am feeling pretty burned out from driving so H. takes over after we both eat the second half of our Subway from earlier. We grab gas ($22) before getting back on the highway. $22

5:30 p.m. — We pull off in Houston, TX and book a hotel for the night ($185 with triple A discount). We try to price-shop around but also want to be in a walkable area so we can see the city a little. We opt out of the $44 valet and find a close garage with overnight parking ($10). The garage is hopefully safer than street parking with our car fully packed. We carry a few essentials up to the room where we both take a quick shower. $195

6:30 p.m. — Walk to a food hall that we found online for dinner. We walk around and look at all the different stands and decide to split a few things: three tacos ($12), three sushi handrolls ($14) and a bubble tea ($4.50). After eating, I’m still hungry so I grab one empanada ($4). Once we’re done we walk up to the rooftop to look at the city skyline. There’s a DJ playing music and a bar but we decide it’s a little too chilly for a drink up here. $34.50

8:30 p.m. — We walk around for 30 minutes. When we get back to the hotel, we decide to each grab one drink at the bar ($15) before heading to our room to watch a movie and go to bed around 11. $15

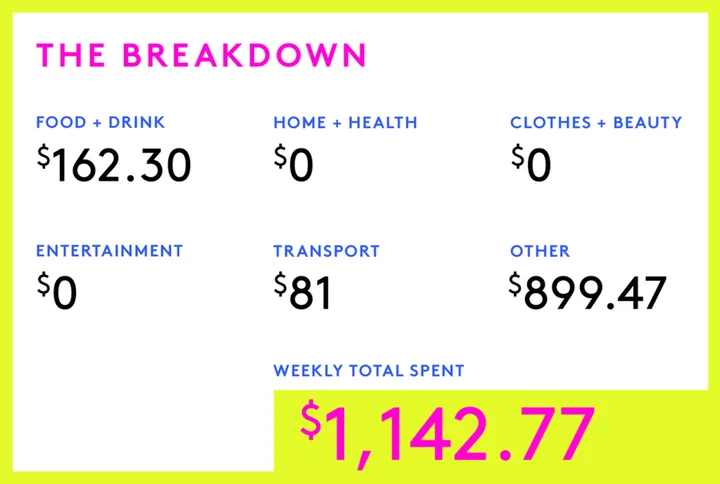

Daily Total: $284.50

Day Two

8:30 a.m. — We wake up and lie in bed together for a little before getting dressed for the gym. H. does some lifting while I do a quick 30 minutes on the treadmill — I recently started a new running program that I’ve been loving. After the gym, we head to the hotel lobby for our included breakfast. We grab eggs, sausage, biscuits and fruit. The free breakfast and included gym is definitely a nice perk for us — this is a nicer hotel than we normally stay in while traveling. We debate checking out some more sites in Houston but decide we just want to get the drive over with and hit the road around 10:30.

12 p.m. — Quick stop for gas ($21) and a quick snack of jerky and a coffee ($7). We power through the last of the drive listening to another episode of The Skinny Confidential. $28

2 p.m. — We get to Austin a little before our apartment is ready so we park ($4) and walk to find lunch. We grab tacos at a food truck ($21) and then walk around our neighborhood. I’ve been here before so I point out some of my favorite places to H. $25

3:30 p.m. — We can finally check in so we move our car to a spot out front and pay to park ($2) while we unpack the whole car. Our apartment is really nice. We paid $1,800 for the three weeks we are here (we pre-paid this so I won’t include it in our spending total). After several trips of unloading our stuff, we move our car a few blocks away where there is free street parking. $2

5 p.m. — We finish unpacking all of our clothes and stuff and head to a Whole Foods down the street. We grab our normal groceries (chicken, salad stuff, eggs, turkey bacon, smoked salmon, berries, pasta, bread, shredded cheese, marinara sauce, chicken sausages) as well as some essentials we need to stock up on for the new place that should last us the whole month (butter, salad dressings, spices, olive oil etc.) ($135). We pop next door to Target for olives and egg whites that we couldn’t find at Whole Foods ($9). $144

6:30 p.m. — We make a big salad with cucumbers, spring mix, microgreens, pepper, onion, olives, avocado, chicken and couscous and eat together while listening to music.

8:30 p.m. — H. and I head out into the city to explore some bars in our neighborhood. We head into one place and get two beers and a tequila soda ($14). After hanging there for a little we make our way up the street to a bar with a really good live band. We grab a couple more drinks each ($23) before calling it a night and walking home around 11. $37

11:30 p.m. — Quick skincare and teeth brushing before getting in bed. l don’t have a lot of skincare since I can’t fit much in the car, so it’s just a quick face wash and lotion. We watch HGTV for 30 minutes before falling asleep around midnight.

Daily Total: $236

Day Three

8:30 a.m. — I wake up and scroll on my phone in bed for an hour while H. sleeps. Once he wakes up around 9:45, I get up and make us both egg white scramble with turkey bacon and peppers on toast. We also brew some of the coffee that was included with our Airbnb.

11 a.m. — I head to the gym for a 30-minute treadmill session followed by an upper body lifting session. The gym is in our building, which is so convenient. When I get back, I quickly eat some leftover chicken and raspberries before hopping in the shower and doing my makeup. I have a pretty easy makeup routine: light foundation, concealer, bronzer, mascara and I’m done. Tomorrow is a holiday so we’re headed out to a bar to meet up with a friend who lives in the city. Since it’s 1.5 miles away we call an Uber. $6

12:30 p.m. — We get to a fun outdoor bar where everyone is watching basketball. Our friend, F., and her boyfriend are already there and buy us our first round of drinks. We grab the next round ($26) and meet some of their friends who also live in Austin. $26

2:30 p.m. — We grab some mozzarella sticks, taquitos and another round of drinks ($26) before heading to another bar with the whole group. Here we play cornhole and get a couple more drinks ($34). $60

6 p.m. — A few of us uber back to our apartment ($8) and then walk to a restaurant up the street. H. and I split a burger, chicken sandwich, fries and two more beers ($49). We head to one more bar but H. and I opt for waters. Around 11, we decide to head home and we’re close enough to walk. We watch TV in bed for a little bit and are asleep before midnight. $57

Daily Total: $149

Day Four

9:30 a.m. — H. and I sleep in later than I would like. I am working east coast hours so I try to get up a little earlier on the weekends but today is a holiday so I guess this is a treat. H. gets up and makes us toast with avocado, cream cheese, smoked salmon and cucumbers. I pour some coffee and we eat together.

10:30 a.m. — We head to Target to look for some stuff our apartment is missing and a couple more groceries. We pick up bleach, more turkey bacon and breadcrumbs but the other household items seem expensive so we decide to head to Dollar Tree. On the way to the register, I grab a cute shirt that catches my eye. We have $5 left on a Target gift card that we use and I pay the remaining $30. $30

12:30 p.m. — On the way to the car we pass a smoothie place that looks good so I grab a protein smoothie ($6.50). At Dollar Tree we grab sponges, aluminum foil, Ziploc bags, two frying pans, toothpaste, flossers and some plastic cups ($21). $27.50

1:30 p.m. — Get home and relax. We make another big salad with the leftover chicken and couscous. H. eats and heads to the gym but I’m still full from my smoothie. I curl up on the couch and read while he’s gone.

3 p.m. — I eat some salad, start a load of laundry and head to the gym for a long walk and lifting. When I wrap up I head to our pool to lie out with H. in the sun.

5:30 p.m. — We’re both hungry after our workouts so we make an early dinner. H. makes chicken parm and pasta — normally I cook but this is his specialty dish so he takes the lead. We eat together and chat about a trip to Italy we are planning in a couple of months.

7:30 p.m. — I snack on some raspberries and chocolate while catching up on work for 45 minutes. Normally I don’t need to work on days off but with the holiday today and me taking Friday off, I have a few things to catch up on and I likely won’t have time tomorrow.

10 p.m. — I head to bed with H and we watch TikTok in bed for an hour. I toss and turn until almost midnight.

Daily Total: $57.50

Day Five

7:15 a.m. — My alarm goes off but I am not feeling ready to get out of bed and surprisingly don’t have a meeting until 8. I check my emails and Slack quickly and then close my eyes for another 20 minutes. At 7:40, I decide it’s finally time and rush to get ready and eat breakfast. I make two pieces of toast with avocado, cream cheese, smoked salmon, cucumber, microgreens and two pieces of turkey bacon and eat while I start my first block of meetings. I have six hours of calls scheduled for today so I know it will be pretty busy.

11 a.m. — H. and I head out for a quick walk during a break. When we get back, he heads to the pool while I head back to our place to work on a presentation.

12 p.m. — Reheat some chicken parm and pasta and eat lunch with H. I put my laptop away for 30 minutes and try not to think about work. After this break, I need to finish up my presentation before my afternoon calls start.

3:30 p.m. — We wrap up work early and head out to grab some groceries. We’re hosting friends this weekend so we want to stock up. We get most of what we need at Target (garlic bread, grapes, ground turkey, prosciutto, onion, popcorn, peanut butter, marinara sauce, pesto, cold brew, protein bars, $55) and then head to Whole Foods for a couple more things (pizza crust, avocado, tomatoes, pepper, zucchini, $11). We walk home and each make a piece of toast for a snack. $66

5:30 p.m. — We head to the gym together. I go for a run on the treadmill followed by a long stretching session and some weights. Today’s run is pretty hard on my legs and I’m glad tomorrow is a rest day.

6:30 p.m. — I cook some roasted potatoes, roasted carrots and vegan sausages with H. for dinner. After eating together, I take a quick shower and then we decide to play some cards.

9:30 p.m. — H. and I head to bed a bit early. We’re both reading good books right now so we read together in bed for about an hour and a half before turning out the lights around 11.

Daily Total: $66

Day Six

6:30 a.m. — I wake up and quickly get ready for the day — quick makeup, hair in a braid and throw on leggings and a sweater. Hop onto my first call at 7 while sipping on a coffee.

8 a.m. — I make two pieces of toast with tomato and avocado. I realize we’re out of bread and didn’t pick any up yesterday. I debate making H. some breakfast but I don’t think he will be up until closer to 9 and don’t want it to get cold. I head back to work. I have back-to-back calls for the next couple of hours but I try to answer some emails in between.

11 a.m. — I’m ready for a break so H. and I go on a walk together to get some sunshine and fresh air and pop into Whole Foods for more bread. $6

12:30 p.m. — H. orders us Grubhub from a place up the street for lunch — even though we have tons of groceries, he gets a $25 credit towards lunch every week through work so we need to use it. He gets a chicken salad wrap and I get chicken with rice, beans and queso ($21, paid for by his work). I try to eat during an hour-and-a-half call I have with my leadership team.

2:30 p.m. — I decide I need a break and go lie out by the pool where H. is working on his laptop. I briefly fall asleep and wake up to my phone vibrating with Slack messages. I head back upstairs and do 30 minutes of work and then log off around 3:30.

4 p.m. — H. and I head to a new neighborhood to check it out. We walk around some shops but don’t buy anything. Then we get offered free beers from a vendor and each have one while chatting with him about Austin. He gives us some recommendations and we make sure to write them down for later.

6 p.m. — Back home we make homemade pizza with pesto, prosciutto, caramelized onions and a few types of cheese. I also mix up a small salad with some veggies we need to use up. After dinner, we play cribbage and then watch a movie together.

10 p.m. — Head to bed to read our books but after a little while I decide I just want to scroll on my phone instead. H. finishes his book and we both go to sleep around 11.

Daily Total: $6

Day Seven

5:30 a.m. — I am not happy with today’s wake-up time but I have a call with a high-priority customer at 6 a.m. I quickly get ready and splash cold water on my face to wake up. I have back-to-back meetings from 6 to 10 a.m. so I quickly eat some egg whites with veggies and make a coffee before my first meeting.

10 a.m. — I have an hour break and decide to spend it lying in bed. A few of our friends are visiting for the weekend and they arrive around 11. We’re all excited to see everyone but most of us are working for the afternoon so we disperse throughout the house on our laptops.

12 p.m. — I make everyone sandwiches with pesto, prosciutto, tomato, arugula and burrata for lunch. We also snack on some popcorn and catch up. It’s been a couple of months since we have all been together.

2:30 p.m. — I wrap up the last of my meetings — I had nine calls today and my brain is feeling very fried. Sometimes context-switching between such different topics (customer meetings, pricing discussions, meeting with my engineering leads about security concerns etc.) can be really draining. I finish sending out a couple of emails and log off around 3:30.

4 p.m. — I quickly head to the gym while my friends wrap up work. Then we all go grab some wine from Target to have with dinner. I pick up beers for H., wine for me and seltzers to have in the fridge for everyone. $31

6 p.m. — We cook pasta with a homemade sauce — ground turkey, peppers, onions, tomatoes and tomato sauce — and also make a big salad and garlic bread. We all eat and have some wine and beers.

7:30 p.m. — We decide to head out to some bars on our street and a bouncer lures us in with free drinks for girls. H. and the boys buy beers and the girls get free drinks ($5 for H.). $5

9:30 p.m. — We head to another bar and our friend buys a round of drinks for everyone. I pick up the next round ($38) and then decide I should call it a night on drinks since I have work tomorrow at 7 a.m. Around 10:30, we walk home and on the way each grab a slice of pizza. H. pays for me and one of our other friends ($9). $47

Daily Total: $83

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.