Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a graphic designer who has a joint income of $125,000 per year and spends some of her money this week on a kayak.

Occupation: Graphic Designer

Industry: Architecture

Age: 26

Location: New Haven, CT

My Salary: $55,000

My Husband’s Salary: $70,000

Net Worth: -$58,000 ($6,000 in checking, $5,000 in emergency/sinking funds, $13,000 between our two individual 401(k) retirement accounts (I just started mine a year ago), $8,000 in car value, minus $90,000 in student loan debt between the two of us. My husband and I have joint finances but have separate accounts for fun money).

Debt: $90,000 (student loans between me and my husband).

My Paycheck Amount (weekly): $715

My Husband’s Paycheck (2x/month): $2,195

Pronouns: She/her

Monthly Expenses

Rent: $1,750

Electric: $150

Wi-fi: $25

Gas: $35-$50

Student Loans: Paused for the time being, it will probably be about $500/month between us when they resume.

Gym: $100

Cell Phones: $200

Car Insurance: $150

Donations: $25

Spotify: $10 (we get our other streaming services from our cell phone provider/family).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There was never an expectation for me to attend higher education. My parents were really surprised when I told them I wanted to go to university and instead pushed me to go to community college first. I went to a college prep high school so I was surrounded by people who told me going to college was the right thing to do. I knew what I wanted to study so I attended a four-year state school, with some scholarships here and there but mostly paid for with student loans and one Pell grant. I am a first-generation college grad.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents had a dicey relationship with finances, which resulted in bankruptcy when I was young. At the time I didn’t really know what that meant and I never really felt poor, but I also didn’t have anyone else to compare myself to. When I got to high school, it was more apparent that my parents sacrificed a lot to keep me in sports and extracurriculars. They never really got into money except for basics like savings and opening a credit card early on but keeping utilization low. When they dropped me off for college, they made it apparent that I was on my own and they wouldn’t be able to help with tuition or living expenses.

What was your first job and why did you get it?

My first job was as a hostess at my friend’s family restaurant at 15 so I could have spending money for myself. It was awful but I learned a lot from that experience. I did a variety of other part-time gigs after that and picked up jobs at the library, internships etc. when I went to college because I was supporting myself.

Did you worry about money growing up?

Yes and no. When I was much younger I didn’t worry that much because I felt like our situation was normal. We lived in a small house, my parents always fed us, clothed us etc. We never took lavish vacations, we would always just go to visit family members. When I got older, I definitely worried about money a lot because I wanted to fit in with everyone by having a car, going on nice vacations and having shopping money, but my parents never provided any extras for me — I had to provide my own spending money.

Do you worry about money now?

Again, I do and don’t. I am honestly making more money than I thought I would (with ambitions to make more in the future, of course) but I do feel very behind in terms of savings and retirement. I just started contributing to a 401(k) within the last two years since I’ve become eligible. It’s definitely a goal of mine to beef up my accounts for the next five years while we also save for a future home purchase.

At what age did you become financially responsible for yourself and do you have a financial safety net?

The day my parents dropped me off at college at 18. I think my husband’s family might support us a little if we ever lost our income.

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

7 a.m. — Wake up after getting snuggles from my dog. My husband, C., likes to give in and feed him when he wakes us all up at 6am but I happily say nah and sleep through it. I get up, put on some casual clothes and head out to get bagels for breakfast. It’s our anniversary today! I submit our order through their app (two coffees, two bagels), walk the dog first, then get in the car and drive to pick it up. $21

8 a.m. — We sit down to eat at the table before we both head off to work. I get giddy because I hired an actor we both like from Cameo a week ago to make us a happy anniversary video and now we’re about to watch it together. C. doesn’t know who it’s going to be, after having bad guesses all week. We watch it and he’s super excited and says he did not see that coming. It makes me happy to see him smile so much. I smooch him and the pup and then I zoom off to work on my scooter.

9 a.m. — Get into work and start drafting some social media posts for next week while finishing up my audiobook for this month’s book club.

12 p.m. — C. and I go home for lunch to save some money. I start to make us grilled cheese on a fresh sourdough loaf and some chips. C. walks in and surprises me with a HUGE flower arrangement that resembles my wedding bouquet. BIG BIG SCORE, C. I love this man. I cut them down and put them in some fresh water. We eat lunch while catching up. C. paid for the bouquet using the joint account. $127.62

5 p.m. — I mostly just hang out with my coworker for the rest of the day. I zoom home and immediately jump in the shower to freshen up. C. gets home and takes the dog out.

7 p.m. — We walk over to an Italian restaurant that we’ve always wanted to try. We order a bottle of chianti (feelin’ fancy tonight), calamari and shrimp, C. gets the carbonara and I get the bolognese dish. The food is so good. We reminisce about our honeymoon. We finish off the bottle of wine and talk some more about C.’s new job and how he’s liking it so far. C. pays using our joint travel credit card. $157

9 p.m. — We walk home, cuddle, do our skincare routines and then finally fall asleep around 11:30.

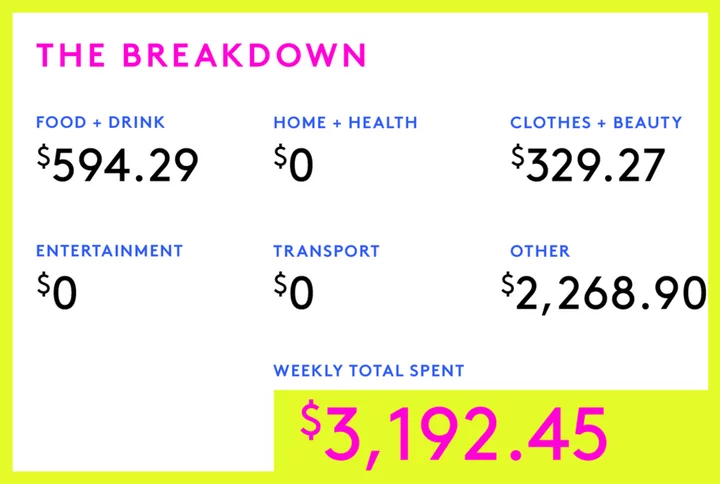

Daily Total: $305.62

Day Two

7 a.m. — Wake up feelin’ a little too cozy so I stay in bed, knowing that this is my WFH day. C. showers and complains about how tight his neck and shoulders feel from last night’s wine. Ugh, getting old. I scroll on my phone and catch up. Then I finally put some clothes on, brush my teeth and we take the dog out together.

9 a.m. — After our walk we see that Oru Kayak is having a sale and finally decide to buy a kayak. These suckers are pricey but we’ve been debating for months (years, really) if this should be a little gift to us for our anniversary. We make the promise to ourselves to take it out nearly every weekend this summer. We buy the tandem with some seat cushions and two oars. Total is $2,069 including shipping. I take it out of our savings and then I ask C. to transfer some money from our gadget sinking fund over to our savings to help cushion it a little. $2,069

12 p.m. — Work isn’t really busy this morning so I take a break and eat leftover pasta from last night, scroll through social media and take my dog out for a walk around the park. I stop for coffee and get an iced chai for me and a small iced coffee for C. $11

2 p.m. — I get settled back at my desk and am reminded of a telehealth appointment with my doctor in an hour. I take a quick shower before my appointment.

3 p.m. — Take my telehealth appointment. We discuss some dietary changes that need to be made and getting ready for my body to transition off birth control in six weeks. Yikes, I’m scared. My copay is covered through my FSA account, which is pre-tax dollars.

5 p.m. — I finish up my day and close my laptop. I remember that I need to place an Amazon order for some 35 mm film for my upcoming trip to the desert. I get a four-pack of Kodak ColorPlus, some more chapstick since I’m running low and a padlock for my gym locker since I lost mine. I have my first ever book club meeting tonight so I throw on some makeup and jeans, then head over to my friend’s apartment so we can carpool. $72.28

7 p.m. — We get to our meeting location and I am hungry so I order a panini at a nearby café ($13.42). We wrap up around 9pm and it’s really nice to be with new people. My friend drops me off at my apartment, I say hey to C., do some skincare, brush my teeth, then doze off in bed. $13.42

Daily Total: $2,165.70

Day Three

7 a.m. — I wake up and scroll for a bit.

9 a.m. — Alright I’m up. We take the dog to play fetch around the corner as we think about the structure of our day. We need to tidy up and return our seasonal ski rentals, something we’ve been putting off for weeks. We get back home and do a quick HIIT workout video, shower and make a smoothie.

12 p.m. — We pack up our ski stuff in the car. It’s pouring outside. We drive two towns over to drop off our ski gear and decide that we should do our grocery shopping while we’re out here. But first, lunch. We drive to Jimmy John’s and get our fave sandwiches, a pickle, chips and two drinks. $30.42

2 p.m. — We bounce over to REI since they’re having a member sale and we want to browse around. We think about our upcoming trip to the desert and what we’ll need. We end up buying a pair of lightweight hiking pants each, C. gets a sun hat and we both get hiking socks, all for 30% off. $185.50

3 p.m. — We jaunt over to Whole Foods to stock up for the week. We get mixed veggies, various canned goods, protein powder, chicken thighs, ground beef, eggs, bagels, peanut butter, OJ, butter, soup, frozen waffles, meatless chicken nuggets, frozen fries, yogurt, bananas and cherries. I nearly choke at the price. When did groceries get so expensive? $243.04

5 p.m. — Finally home after a harrowing day of nonstop pouring rain and spending money. We unload groceries and feed the dog. Try to take him outside in the pouring rain but he is having none of it. We decide to toss frozen nuggets and french fries in the air fryer for dinner.

8 p.m. — We wind down and watch the ’90s movie Go. It’s interesting but where are these kids’ parents? Head to bed around 10:30 and immediately fall asleep.

Daily Total: $458.96

Day Four

8 a.m. — I wake up, do some light stretching and take the dog for his morning walk. We get back and I start on breakfast, which is a frittata with bell pepper, onion and cheese. I pair it with air-fried potatoes and cherries on the side.

12 p.m. — I do some light tidying up. I decide to run some errands and walk to get some groceries and items we missed yesterday. I get eggs, cucumber, artichoke dip and two avocados ($13.25). Then I head to CVS and get body wash and a new nail color ($25.51). Then I pop over to our local Asian market and grab some kimchi and a frozen matcha wafer sandwich ($10.08). $48.84

3 p.m. — I want to give myself a pedicure so I pull out the foot spa (the best gift I’ve ever received?) and turn on some garbage TV to mellow out and relax. Do my nails, clean up a bit and take the dog out to play fetch. I’m a little tired when we get back so I lie down and snooze for 30 minutes.

7 p.m. — C. starts on our rice bulgogi bowl dinner. It’s amazing and quick and a little spicy this time. We watch Queer Eye while we eat. We take the dog out for another walk around the neighborhood because the weather is amazing. I take a shower, do some skincare and fall asleep around 11.

Daily Total: $48.84

Day Five

8 a.m. — Rise and grind for a Monday, yuck. I take the dog out for his walk and then have avocado toast with an egg for breakfast. I get on my scooter and zoom to work.

10 a.m. — This morning starts with absolute fires. I’m the only one on my team here today while everyone else is WFH so naturally a lot of people come up and ask me for stuff. I start putting together an experience book that someone needs for a presentation for a client.

12 p.m. — Zoom home on my scooter for lunch. C. meets me there and I make myself a ham and cheese sandwich. We take the dog out for a jaunt around the block.

2 p.m. — Back at it with my experience book. There seems to be another fire; we need to overnight some books to a client but the office manager who usually does it is not here so I have to do it myself. I get the books in a box, process the label and go to the FedEx store to drop the package off. By then it’s nearly the end of the day so I just go home afterward.

5:30 p.m. — Head to the gym to blow off some steam after a dumpster fire day!

7 p.m. — I throw together a dinner of gnocchi, asparagus and pesto. It is delish. I wrap up the night by showering, watching Queer Eye and doing my skincare. I call it a night around 10 and head to bed. Yay, no-spend day.

Daily Total: $0

Day Six

6 a.m. — I stir awake and realize that C. is leaving for a run. Proud of him but I think I’ll go back to sleep.

7 a.m. — I wake up and try on some clothes in a Stitch Fix box I ordered a while ago that came yesterday. I love all the pieces but definitely can’t afford all of them. I end up buying some white crop trousers and a black crop top that C. thinks I look good in. I’ll wear the white trousers to work today. I check out in the app. $118.26

8 a.m. — Take the dog for his walk and then put together a breakfast of a chocolate protein smoothie and a bagel with probiotic cream cheese. I’ve never seriously had protein shakes or smoothies and this makes me so stuffed that I can’t even finish it. I look down at my new pants that I’m wearing and realize there is a ripped hole where the crotch is. I get mad. I just bought these! I change outfits and rush off to work and decide to deal with an exchange later.

12:30 p.m. — This morning is quiet so I crack down on laying out the experience book while starting a new audiobook. I break for lunch, which is a frozen bean and cheese burrito that I heat up and munch on some cherries while it cools down. It’s too beautiful to not take a walk so I head out after I finish my lunch and listen to some music as I walk around campus.

5:30 p.m. — The rest of the afternoon flies by as I keep working on the book I’ve been laying out. I leave right at 5:30 and get a call from a recruiter I’ve been working with. I come out disappointed that a job that I had gone through four rounds of interviews for does not want to move forward with me. They didn’t have any constructive feedback or reasons why. I feel frustrated that I wasted two months.

7 p.m. — We play fetch with the dog and sip on a glass of wine while commiserating about a hard day. We decide it’s an Uber Eats and movie night so we order our favorite Thai food (pad Thai for me and drunken noodles for C., and an order of crab rangoons). We turn on How to Lose a Guy in 10 Days. I instantly feel better. $60.94

10 p.m. — I doze off on the couch and realize it’s time to carry myself to bed. Goodnight.

Daily Total: $179.20

Day Seven

6 a.m. — I promised C. I would get up and stretch with him this morning so we go upstairs to do some light stretching and sip on tea and coffee. We’re trying to be more mindful and meditative about our moods and feelings so I think about yesterday and meditate for a little. The morning light is coming in and making the room orange, everything is beautiful. We decide to take the dog for some morning fetch to tire him out.

8 a.m. — Breakfast is frozen waffles with peanut butter, cherries and half a chocolate protein shake. We set off on our walk to work.

12 p.m. — I mobile order an iced chai with oat milk and a ham and cheese croissant from Starbucks. The order is $8.63 but I reload the Starbucks app with $15. $15

5 p.m. — Wrap up some more edits on the book I’ve been working on all afternoon. I head home to C. setting up for his therapy appointment, which has a copay of $30 but we use our already loaded FSA funds to pay for it. I take the dog for his walk. While out, I pick up another bottle of wine from the wine shop. Once C. gets off his therapy appointment, we drive to the FedEx store before they close so we can pick up our kayak! That’s one good thing about this week. $19.13

7 p.m. — I get to making dinner, which is Spanish rice and chicken thighs. Watch an episode of Selling Sunset, then I take a shower and lights out at 10:30.

Daily Total: $34.13

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.