Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Have you been affected by inflation? We want to hear from you! Using this form, share your own experience with rising costs, stagnant wages, and creative ways to save money.

Today: an engineer who makes $361,000 per year and spends some of her money this week on a Reformation dress.

Occupation: Engineer

Industry: Tech

Age: 28

Location: Northern California

Salary: $361,000 ($196,000 base, ~$15,000 bonus, ~$150,000 of RSUs being released this year).

Net Worth: $1,071,000 (house: $759,000, retirement: $210,000, investments: $520,000, HSA: $6,000, HYSA: $26,000, checking account: $7,000, minus mortgage: $457,000).

Debt: Mortgage: $457,000.

Paycheck Amount (2x/month): $4,678

Pronouns: She/her

Monthly Expenses

Rent: $790 (I split a room 50/50 with my partner, T., in San Francisco. We live in a four-bedroom apartment with some of my closest friends).

Mortgage: $1,920 (I have a house in a vacation town and we go between the two places).

Utilities: $565 (house + apartment).

Phone: $0 (work pays).

Health Insurance: $80

Home Insurance: $480

Car Insurance: $60

401(k): $975

HSA: $200

Investments: $1,500

Climbing Gym: $90

The New York Times: $20

Annual Expenses

Amazon Prime: $140

Ski Pass: $550

Credit Card: $95

CalTopo: $50

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. My parents both have advanced degrees and I was a very dedicated student in high school. Less than a quarter of the kids in my high school went on to college and I very much viewed college as the way out of my struggling rural town. My parents each paid for a third of my college, including using a college fund that they (and many relatives) had contributed to over the years. I took out federal loans for the remaining third (about $25,000), which I paid off within a couple of months of starting work. I received both scholarships and financial aid from the school.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents are unamicably divorced and their relationship worsened throughout my school years. By the time I was in high school, they barely spoke and I was the intermediary for communication around custody time and money. After the divorce, my dad started making much more than my mom (who has primary custody). There were frequent, bruising fights about custody, child support, extracurriculars, college for my little brother and me, and constant threats of going back to family court…all funneled through me. On the minus side, I now have a deep fear of ever being reliant on anyone else for money. On the plus side, this was an excellent education on how money works in the real world. My parents have both always been open with me about their financial situations and worries and offered generally sound advice.

What was your first job and why did you get it?

I started working on weekends as a ski instructor in the winter when I was 16. Once I started college, I worked research or TA jobs during the year and internships over the summers. I used the money from my jobs for clothes, eating out and travel. I also paid for housing/food/transport over the college summers.

Did you worry about money growing up?

I never worried about having my basic needs met. I could participate in extracurriculars and we would go on vacations. My parents were both frugal around eating out, new clothes and the latest technology — they valued travel and experiences more than things. I worried constantly about money in a different sense, though. It was such a source of conflict in my family — it always seemed like money was one fight from tearing us all apart.

Do you worry about money now?

I know that rationally, I am fine. I maintain a detailed budget/spending tracker and review my finances every month. I have more concrete worries that I will get laid off with the current climate in tech, or that my lovely and cheap group living situation will fall apart and I’ll have to pay way more in rent.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became independent at 22 when I graduated college. I have my own safety net and I know my parents would both be willing to help out if I needed it.

Do you or have you ever received passive or inherited income? If yes, please explain.

I inherited $15,000 from a great uncle, which went towards my down payment. My dad also loaned me $15,000 for my down payment. I’ve tried multiple times to pay him back but he refuses. I guess it’s a gift at this point.

Day One

7 a.m. — I wake up slowly to the sound of blue jays fighting outside my window. I’ve been working remotely at my house this week since I was summoned for jury duty. I scroll social media and read the news for half an hour before fishing my laptop out from under the bed. I work with people all over the world and logging on in the morning allows me some back and forth with coworkers in other time zones.

8:45 a.m. — I reluctantly leave the warmth of my bed and make my daily chai tea latte with collagen before relocating to my desk for a team sync.

9:30 a.m. — I check Find My and see that my partner, T., will be arriving from SF in less than an hour. I start cleaning up the kitchen and our room. When it’s just me in the house, I can’t be bothered to clean. I’d always rather do something else like go outside or mindlessly scroll social media and for me, there is something indulgent about not caring about mess. While in the kitchen I take out the whole wheat bagel dough I made yesterday and shape/boil/bake them.

10:15 a.m. — T. arrives! I help him bring stuff up to our room and then pull him into bed for some quick sex. I get dressed again in bike shorts and a sweatshirt, make some oatmeal for breakfast/lunch, and head back to my office.

12:15 p.m. — I check my personal email and see a response from a mountain hut in Italy I’m trying to book for a trip this summer. They want me to send a deposit to an Italian bank account. I make a Western Union account and wire the deposit, which feels sketchy and is way too easy. I may have just thrown $50 into the void, who knows ($56.13)? I do some more itinerary planning for the trip, book my flight out with points ($5.60) and email my mom about my arrival time in Zurich. Part of the trip will be a family reunion for her side of the family in Switzerland, then T. and I will travel together after. $61.73

12:45 p.m. — I buy a black linen mini dress from Reformation that I’ve been eyeing ($236.81). Planning my travel wardrobe is almost as fun as planning the trip itself. Everything will have to fit into a backpack but constraints breed creativity! $236.81

1 p.m. — I sear some chicken for lunch and we eat it with leftover hoisin sauce, salad and a bagel. We go for a little walk around the block and get back to work.

5:30 p.m. — Two of the four friends we are going to ski with this weekend arrive and we discuss plans and gear. We decide to camp tonight to get an early start, and they head out. I still haven’t packed so I sign off work, pack for the weekend and make some pancakes for breakfast tomorrow.

8:30 p.m. — T. and I get Taco Bell ($7.69) and gas ($77.70) on our way. Both go on our shared card, which we split 50/50 at the end of the month. I make slightly more than T. but an equal split is what feels right to both of us. We listen to an episode of Normal Gossip. $42.70

10:30 p.m. — We arrive at the trailhead, pull off the road by our friends’ cars and settle into the back of the car to sleep.

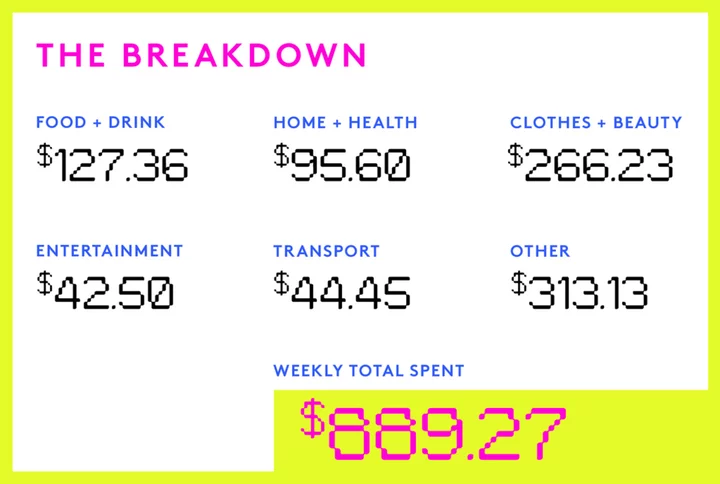

Daily Total: $341.24

Day Two

5 a.m. — My alarm goes off and I remind myself that this is fun. I force down some pancakes and put on sunscreen. The boys have a *very* big day planned a bit further south. The other women and I head to the start of our up-track, do our safety checks and start moving.

10 a.m. — We stop and I have a bagel, a bar and some Gatorade. By this time we are at over 10,000 feet and starting to feel the altitude. More concerningly, it is hotter than we expected, meaning slushy snow. We decide that we are not going to make it to the peak in time and pick out a closer objective. With some of the time pressure gone, we slow down a bit and talk about work, boy problems and if we should freeze our eggs while we continue up.

11:15 a.m. — We transition our skis and boards to downhill and enjoy the descent. Back at the cars, we chat and I eat a cookie.

2 p.m. — We all meet up at some natural hot springs and wander around, looking for a good pool. I start reading book one of the Scholomance series through Libby.

4:30 p.m. — We head to a brewery where T. and I split a BBQ chicken plate ($23 on our shared card). I’m feeling too wiped out to want any alcohol. We discuss plans for tomorrow. Given our experiences today, we will need to start even earlier tomorrow morning. T. and I both value sleep too much for that so we say our goodbyes and drive back to our house. $11.50

7 p.m. — Back home! We get into the hot tub and then unpack the car and shower. I have a protein shake.

8 p.m. — We make a big bowl of popcorn and watch an episode of The White Lotus (we are way behind the times, as always). I read for a bit after and am asleep by 10:30.

Daily Total: $11.50

Day Three

6:45 a.m. — I wake up with a headache. It’s too early to be up. I take an Advil, drink half a liter of water and shimmy back into T.’s arms.

8 a.m. — We wake up for real this time. We make tea (for me), coffee (for T.) and protein waffles. After a slow breakfast, T. cleans the kitchen and I start some laundry.

10:30 a.m. — T. showers, which turns into sex. Now back in bed, I decide to read just one chapter but end up finishing the book. I have zero control around fantasy books and try to limit myself to a couple per month.

2 p.m. — I reserve the next in the series on Libby and go forage in the pantry for lunch. I come up with a bagel, a tuna packet with spicy mayo, a clementine and some ice cream. We need to go grocery shopping. T. comes in from working on his car and we plan some meals. He volunteers to go to the store if I work on the built-in shelf I’ve been meaning to start for about a month. I know if I don’t finish it soon, he will just do it himself. It’s one of the last things remaining for our guest bath renovation.

3:15 p.m. — T. returns from the store with fruit, veggies, tofu, body wash, mozzarella, cream, cream cheese and chicken ($44.49 on our shared card). This is missing several critical ingredients from our list, which he says he couldn’t find. If T. doesn’t find something in the store in two minutes, he gives up. I vacillate for a bit and decide that I’d rather get the remaining ingredients now than later in the week. $22.25

4 p.m. — I head out to the grocery store and get salmon, parmesan, pasta sauce, artichokes, eggplants and garlic, which were on the list. I also get Pop-Tarts, a mango, eggs, pudding, maple syrup, cereal and drawer organizers, which were not ($49.50). T. doing the shopping is way better for our budget. $24.75

5 p.m. — T. starts making some chicken and eggplant parm while I continue with the built-in. We split a hard kombucha.

6:30 p.m. — After dinner, T. joins me in the garage and works on a shelf he’s been making for his sister’s baby shower next month. I help him pick a stain, then do some planning for the painting I want to give her. I abandon the built-in and start on the painting. My dream as a high schooler was always to be an architect or artist and I came dangerously close to going to art school instead of engineering school. Engineering still has lots of interesting design and problem-solving work, pays well, and I can pursue art projects and house renovations on my own terms. I have no regrets.

10:30 p.m. — Lights out!

Daily Total: $47

Day Four

7:30 a.m. — I wake up and scroll on my phone and cuddle with T. while he slowly wakes up. I get right into my coveralls since I know I want to keep working on the guest bath today. Next up is my daily tea and logging in to work. I set up a couple of meetings for the week but there isn’t much this morning.

8:30 a.m. — I do some online shopping while eating a leftover pancake with pudding on top. I get Sephora eyeshadow ($4.18), MDSolarSciences SPF lip balm ($25.24), and four hand towels from H&M that will go on my new shelf ($26.06). I put away our laundry. $55.48

9:30 a.m. — I start on a training course for a new software tool. I make it half an hour into the video before I realize I’m just staring out the window, watching a squirrel deconstruct a pinecone. I learn best by doing so I download the tool and start transferring my designs over. The interface isn’t that different and by lunchtime I have everything updated.

11:30 a.m. — We reheat some leftovers and work on guest bathroom renovation over lunch. T. caulks some of the seams in the new tiles we laid and installs the cabinet doors for the vanity while I continue with the shelf.

2 p.m. — My back is sore from crouching awkwardly on the bathroom floor so I relocate to the hot tub for my next meeting. It’s a big review and I’m not presenting so I don’t need to have my video on or say much. Long live WFH. The data presented is interesting and I spend the rest of the day absorbed in working on new design ideas that incorporate what we learned. I eat a Pop-Tart.

6:30 p.m. — T. comes into my office and reminds me that if we don’t leave soon, we will get back to SF really late. He’s right. I save my work and frantically pack for 15 minutes. We water our plants and close up the house. I make smoothies for us before heading out and I buy some more spa chemicals for the hot tub. $13.93

10:30 p.m. — Back in SF. We listened to Planet Money and Midnights on the way home. Was it secretly a breakup album? The people want to know!

Daily Total: $69.41

Day Five

6 a.m. — I wake up and can’t fall back asleep. After a week in the woods, I’m not used to the noise of the city. I read the NYT for an hour and then check on work.

7:30 a.m. — Today I’m going into the office so I try with my outfit. I put on hard pants for the first time this week, a linen shirt with tigers on it and loafers. Many of my coworkers wear sweatpants every day so I know it doesn’t matter, but I like clothes. For my morning skincare routine, I rinse my face and then put on either The Giving Essence or an iNNBEAUTY vitamin C + peptide moisturizer followed by Supergoop sunscreen and Herbivore eye cream. I also put on some super light makeup for work: Glossier concealer under my eyes, Cloud Paint and a spritz of perfume. I make my tea and catch up with my best friend/housemate, F., in the kitchen. We discuss plans for a picnic this weekend with some college friends.

8:30 a.m. — I walk to the shuttle stop. It takes about an hour to get to work and I typically work on the bus. I pay a medical bill I got in the mail from when I broke my arm several months ago and needed surgery. I am still getting lots of little bills as my insurance works out what I owe. $55.61

11:45 a.m. — I buy a grilled chicken salad and a fruit tart for lunch ($10.50) and return to my desk. T. texts me that his friend, J., got several tickets to a concert on Thursday. I’ve never heard of the band but J. is passionate about live music and I trust that it will be a good time ($42.50). $53

5:30 p.m. — On the bus home, I text with my younger brother about helping our mom with a new phone. We decide to secretly order her the one with a nicer camera and split the cost difference between us as a surprise. I contribute an extra $100 on top of that. I order it and venmo her and my brother. $200

6:30 p.m. — T. has started on dinner (orange tofu with eggplants and broccoli) but needs more ginger. I detour to the produce market on the way home and get ginger, an orange, shallots and sage. $4.67

7:30 p.m. — After dinner T. and I bike to the gym. I bike pretty much everywhere in SF. Parking is too frustrating and I like seeing all the people out and about. I lift (legs and core today) and then we climb. I’m still getting my grip strength back post-wrist-breaking and it’s frustrating to feel so weak.

9:30 p.m. — I open a package with a bikini from Skatie. It was final sale and thankfully it fits but the top doesn’t have pads. I carefully cut one of the seams, wiggle some pads from an old sports bra in and sew it back up. I’m oddly self-conscious of my nips showing. For my bedtime skincare routine, I cleanse and then put on either retinol or a moisturizer. I fall asleep immediately while T. reads.

Daily Total: $313.28

Day Six

7 a.m. — T. is going into work early today and points out that I was going to go for a bike ride this morning. I did say that yesterday. I’m still groggy but I put on some workout clothes and bike up Twin Peaks. It’s beautiful and sunny today.

8 a.m. — I shower using Prose shampoo/conditioner, followed by Briogeo curl cream and my normal face routine. Today I wear high-waisted jeans, a cropped T-shirt and a leather jacket.

8:45 a.m. — I make my tea, pack up some leftovers and eat a bar while trotting to the bus stop.

11 a.m. — No seated position is comfortable on my sore butt so I ask my manager if we can walk around campus for our one-on-one. We end up running significantly over. I feel like our meetings are often him venting to me — I go back and forth on if this is good for my career. I eat my leftover tofu after.

12:45 p.m. — I fill up my water bottle and mentally prepare myself for five hours of back-to-back meetings.

3 p.m. — A manager brings doughnuts (praise be!) and I eat a maple one.

6 p.m. — Done with work meetings. I tune into a fascinating webinar about weather patterns and climate change on the bus home. I munch on an apple.

7:15 p.m. — I make salmon with artichoke and spinach cream sauce for dinner and catch up with my other housemate, H., while T. finishes some work calls.

8:30 p.m. — T. cleans up after dinner while I run to try on the Ref dress, which arrived today. I love it. T. compliments it immediately, which is always a good sign. I realize I left my lunch box on the bus for probably the fifth time this year. I can’t face going to the work lost and found again and decide that the problem is that the bag is black and blends in under my seat. (The problem is me.) I find a used Dagne Dover one online that is light blue and buy it. $57

9:30 p.m. — T. and I do a little vanity night. I trim his hair and he helps me dye my eyelashes black. Learning I could dye my eyelashes was such a game-changer since I’ve never liked how mascara makes my lashes feel stiff. T. plucks my eyebrows as well. I trust this man completely. We both put on a facial peel from The Ordinary.

10:30 p.m. — I’ve been seeing an abnormally high number of messages come through from coworkers in Asia. I log back in to see what is up and work for a bit before bed. COVID destroyed any sense of standard work hours but that goes both ways. I don’t feel bad about coming in late, leaving early or taking breaks during the day.

Daily Total: $57

Day Seven

7:45 a.m. — I wake up naturally. We basically never set alarms. For me, waking up to an alarm is waking up already stressed out. Today’s outfit is a dusty purple floral dress and Chelsea boots.

9 a.m. — Before I arrive at work, I text my dad and stepmom to coordinate cat-sitting their cats for a couple of weeks. T. and I have been considering adopting a cat so this will be a good test run and my dad’s cats are so sweet.

12:15 p.m. — I get lunch (beef ravioli) with guys from another team who I’ll be working closely with this year. $10

3 p.m. — I accompany a coworker to get coffee between meetings. I get a fresh juice ($3) and a bag of bunny graham crackers (free from the work snack basket). I see that crypto is down over 5% and shovel $1,000 from my “play investment” fund in. Most of my investment portfolio is standard and safe, though I am comfortable with some amount of risk. $3

4:45 p.m. — I head home early on the bus while doing some mindless email clean-up.

6:15 p.m. — I put on eye makeup, jeans and a sheer top for the concert. T. and I bike to meet our friends for dinner. I try with limited success to re-scrunch my curls in the restaurant bathroom. Everyone gets a bowl of ramen and we split a bottle of sake. T. and I do drink but try to be very intentional about when and how much. Being a bit buzzed for this concert sounds nice. I venmo for my quarter ($29.25). $29.25

8 p.m. — We walk to the concert and stop for matcha ice cream on the way ($7.59). The music is very danceable and the crowd is really stoked for a Thursday. Everything I could want from a random concert. $7.59

10:45 p.m. — We bike home and I’m still buzzing. T. and I drink sleepytime tea and then get in bed.

Daily Total: $49.84

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.