As scorching temperatures ravage farms from the US to China, crop harvests, fruit production and dairy output are all coming under pressure. That extreme weather is just one of threats to food supplies that are once again mounting around the world.

This week, top rice exporter India banned some shipments of the commodity – a staple for about half of the world’s population — to keep domestic prices in check. Russia quit a deal that allowed Ukrainian grain to flow safely across the Black Sea.

On top of that is the recent arrival of the El Niño weather pattern that may cause further damage to agriculture.

All of this is renewing concerns about food security and prices, creating a risk that rampant inflation on supermarket shelves will stick around for longer. That would be a fresh blow to consumers, who were just starting to see some better news after a long-running squeeze on household budgets.

“We’re all still struggling under an inflationary regime,” said Tim Benton, a food security expert at Chatham House in London. “And although inflation is tailing off, that doesn’t of course mean the prices are going down. It means they’re just going up more slowly.”

Extreme heat that’s engulfing huge swaths of Asia, Europe and North America is just the latest challenge in what’s been a rough year for farmers. They’ve had to grapple with bouts of extreme weather, including prolonged droughts, heavy rain and floods.

Right now, it’s so hot in southern Europe that cows are producing less milk and tomatoes are being ruined. Grain harvests will be much smaller too after struggling with drought.

In Asia, the yields from China’s rice fields are at risk, and US conditions for growing crops were at their worst in more than three decades in June, before the Midwest got some rain relief. Prices for rice in Asia recently reached a two-year high as importers built up inventories.

While the full extent of the damage will depend on how long the unfavorable conditions persist, there are already clear signs of destruction in fruit and vegetables in southern Europe, which supplies much of the continent.

In Sicily, some tomatoes have ominous-looking black rings, the result of a so-called blossom end rot, when extreme weather renders plants calcium-deficient.

“They’re like burnt on the bottom,” said Paddy Plunkett, head of global sourcing at importer Natoora who was sent a photo by a grower. “I’ve never seen it before.”

Across Italy, weather-related damage to agriculture will exceed last year’s losses of 6 billion euros ($6.7 billion), according to farmers group Coldiretti.

The temperatures have sped up ripening or caused heat burns on everything from grapes to melons, apricots and aubergines. Bee activity and pollination is affected and wheat production is down, it said.

“This is not a just a regular hot summer,” said Lorenzo Bazzana, an agronomist at Coldiretti. “They say plants should adapt to the climate changes, but we are talking about cultures that evolved slowly over thousands of years, they cannot adjust to a climate that keeps changing so quickly and so dramatically.”

Beyond Europe’s vegetable stalls, the good news is the grains market — key to food security of the poorest and import-dependent nations — is still well supplied, thanks to record harvests of soy and corn in Brazil. Top wheat exporter Russia is set for another bumper crop.

But uncertainties are piling up. In an apt illustration, wheat fluctuated throughout the week in response to a flurry of news from the Black Sea.

It rose on the collapse of export deal, before slipping back, then rose again as Russia threatened ships sailing to Ukraine ports. On Friday, it declined as Ukraine sought to restore the export deal.

More concerns stem from India’s steps to ban exports of non-basmati white rice to put a lid on inflation.

Retail rice prices in Delhi are up about 15% this year while the average nationwide price has gained 9%, according to data from the food ministry. The government may extend the restrictions to other rice varieties, Nomura Holdings Inc. warned.

Elsewhere in Asia, Thailand is asking farmers to limit rice planting to only one crop this year amid drought risks. In China, high temperatures will likely force the early ripening of the crop, impacting yields. President Xi Jinping on Thursday called for greater efforts to secure grain security, state television reported.

Parts of the US are experiencing similar strains.

While rainfall levels have improved after hot and dry conditions earlier this year, the weather is expected to flip again across the Midwest next week and into early August, just as corn and soybean crops go through critical development stages, said Arlan Suderman, chief commodities economist at brokerage StoneX.

The Department of Agriculture forecasts that durum wheat output will fall 16% this year, with other spring varieties down 1%. The market will know just how bad the situation is when crop scouts hit the fields for the annual spring wheat tour in North Dakota next week.

Transport issues may compound the food security concerns. Water levels on the Mississippi and Ohio rivers are falling for a second straight year, raising the prospect of shipping problems on crucial freight routes.

“I would be surprised if global food prices do not start increasing again after over a year of decreasing,” said Caitlin Welsh, a food expert at the Center for Strategic and International Studies in Washington. “We’re experiencing multiple threats to agriculture markets.”

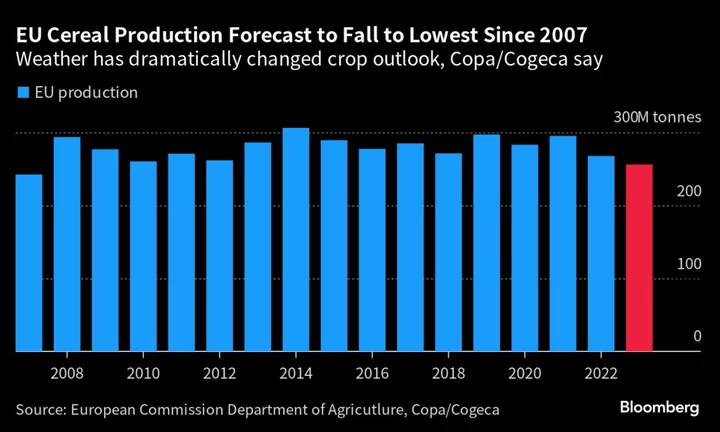

Back in Europe, droughts have meant that grains production in Italy, Spain and Portugal will be as much as 60% lower than last year, contributing to possibly the EU’s worst grain harvest in 15 years, according to farm lobby Copa and Cogeca.

It’s called the situation “extremely worrying.”

“Prices are always stickier down than up,” said Tom Halverson, chief executive of CoBank, a cooperative bank that works with rural businesses across the US. “It takes a lot longer and it’s a lot harder to squeeze inflation out.”

--With assistance from Michael Hirtzer, Áine Quinn, Jasmine Ng, Hallie Gu, Isis Almeida, Megan Durisin and Alessandro Speciale.

Author: Agnieszka de Sousa, Flavia Rotondi and Tarso Veloso