The Philippine central bank kept its benchmark interest rate steady for a fourth straight meeting, looking past last month’s inflation pickup after economic growth slowed and the peso weakened.

The Bangko Sentral ng Pilipinas on Thursday left its target rate at 6.25%, as seen by 20 of 22 economists surveyed by Bloomberg. Two predicted a quarter-point increase.

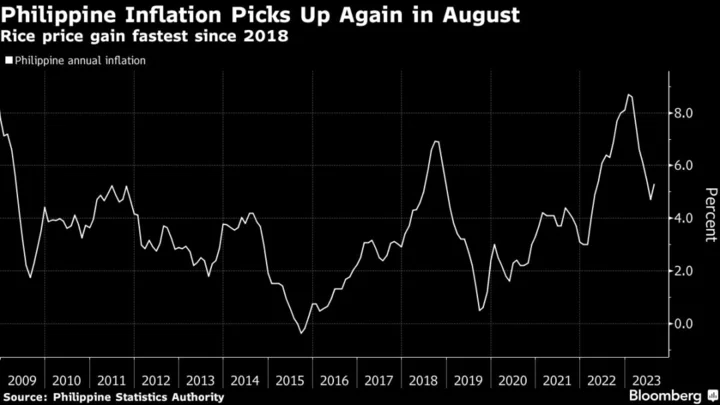

BSP Governor Eli Remolona signaled the pause last week, expecting inflation to return to the central bank’s 2%-4% goal as soon as next month. Food supply shocks, particularly rice — which mainly fanned inflation in August — usually dissipate quickly, he said.

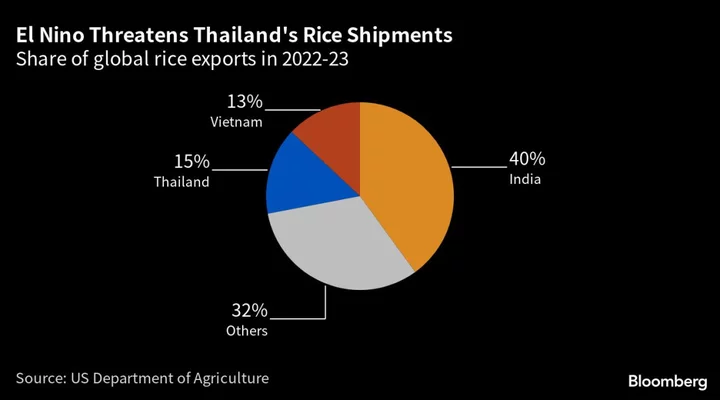

Philippines, among the world’s biggest rice importers, is facing renewed inflationary pressures as India’s export restrictions and reports of hoarding by domestic traders pushed up prices of the staple grain. President Ferdinand Marcos Jr. capped rice prices earlier this month, triggering pushback from some economists and retailers.

Elevated inflation and borrowing costs at a 16-year high are also clouding the economic outlook, with the Asian Development Bank downgrading its growth forecast for the Philippines to 5.7% for this year, below the government’s target of at least 6%. The economy expanded much slower than expected last quarter due to weaker consumption and government spending.

Currency weakness also risks adding to price pressures for a country that imports almost all of its oil needs and about a tenth of its rice requirement. The Philippine peso is Southeast Asia’s worst performing currency this quarter, depreciating 3% against the dollar.

--With assistance from Cliff Venzon, Tomoko Sato, Andreo Calonzo and Cecilia Yap.

Author: Ditas Lopez and Manolo Serapio Jr.